About the Authors

Over recent years, media headlines repeatedly foretold Hong Kong’s decline. This dire outlook culminated in an opinion piece in February 2024 in the Financial Times that declared ‘It pains me to say that Hong Kong is over.’ In parallel, many predictions were made that Hong Kong would become ‘just another Chinese city’ and that its role in bridging capital flows between China and the rest of the world would be taken by cities elsewhere in China, namely Shanghai, or in Asia, most clearly Singapore.

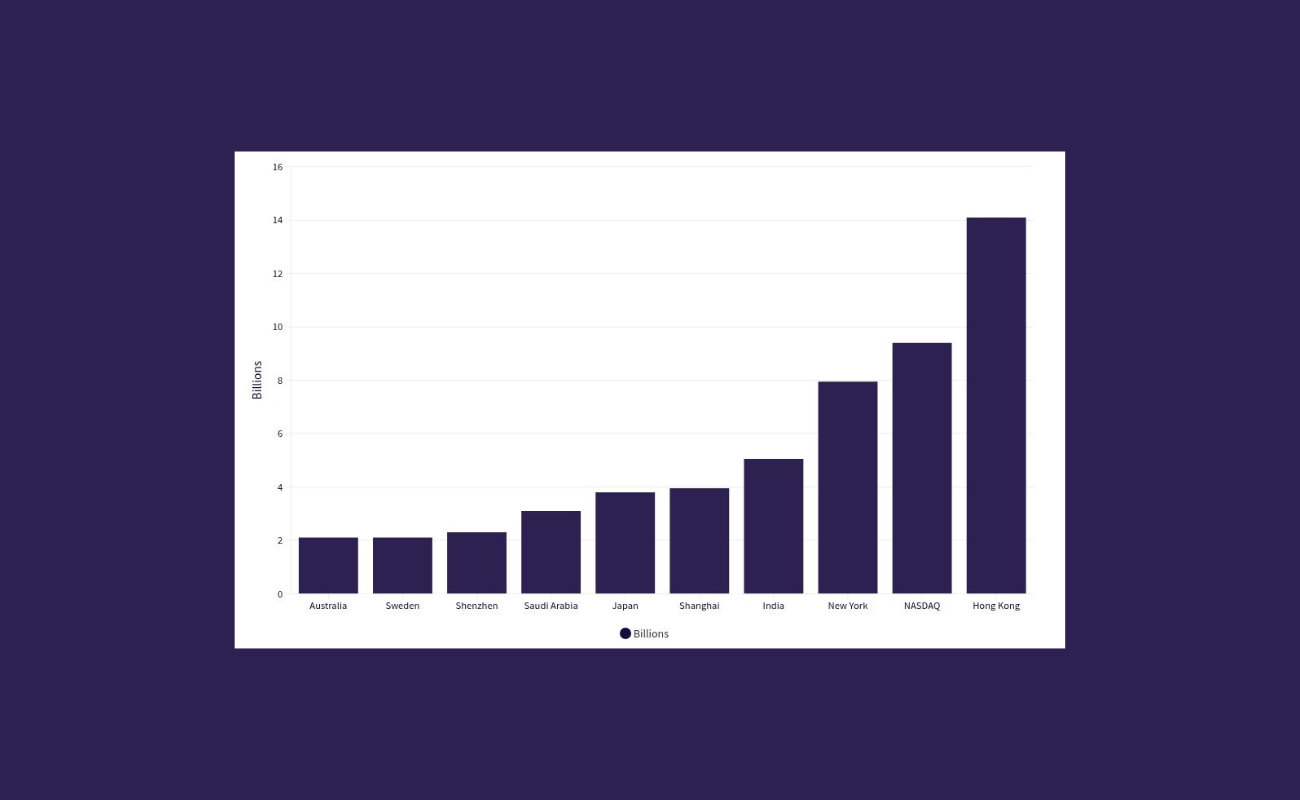

Those predictions have not come to pass. In fact, Hong Kong’s capital markets have been resurgent. That growth has been driven by Chinese companies listed in Shanghai or Shenzhen pursuing secondary listings in Hong Kong, known as the ‘A-share to H-share’ trend. This trend has been supported by a clear policy direction from the government to reinforce Hong Kong’s role as a bridge between the East and the West, a positioning that has in many ways been strengthened by broader geopolitical uncertainty and tensions in Asia and the wider world.

Top IPO Fundraising Venues, H1 2025 ($B)

Capital choosing certainty

Hong Kong’s core strengths have always been about acting as a ‘superconnector’ – a bridge between China and the rest of the world. That ability is founded on two main pillars. First, the legal certainty its common law heritage provides. Second, its unique connectivity into the Chinese mainland financial markets and domestic economy.

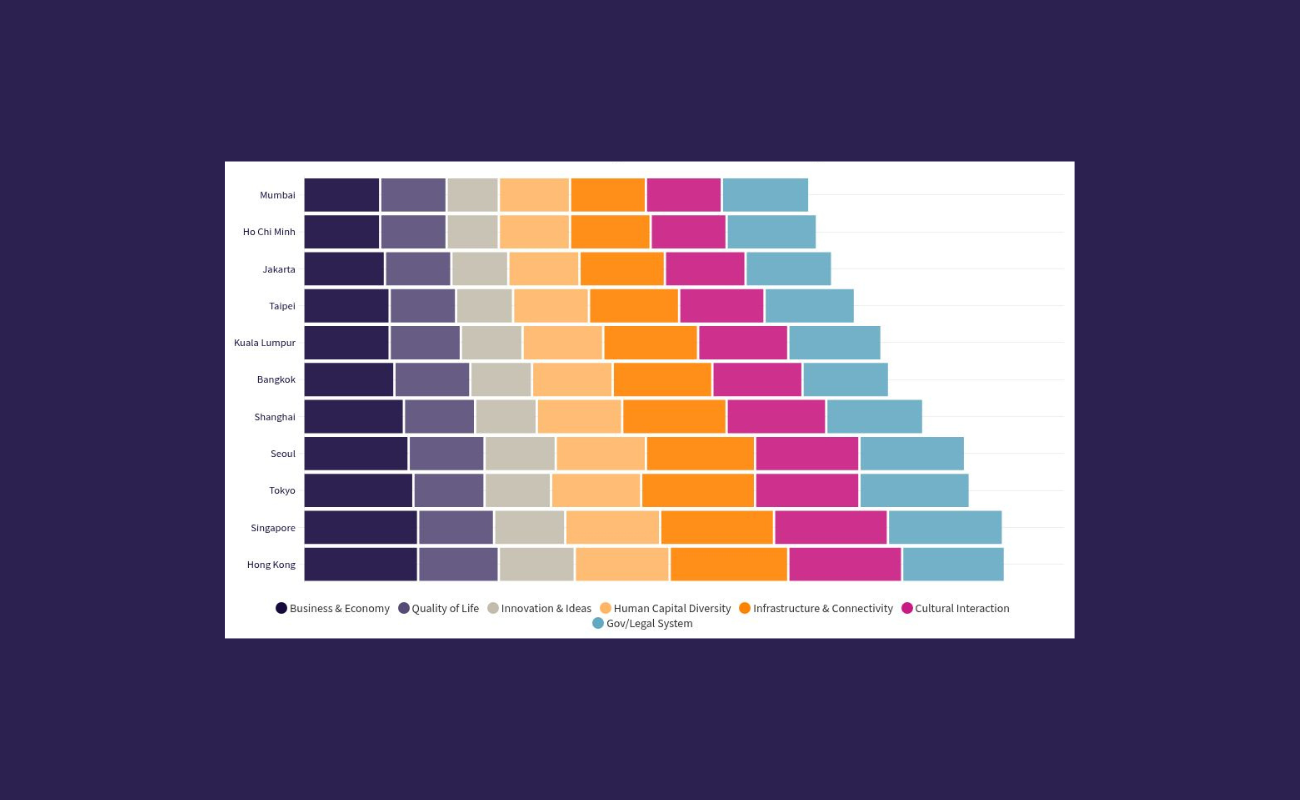

These strengths were shown this year when Hong Kong ranked third globally and first in Asia on the inaugural Asian Cities Internationality Index conducted by the Hong Kong General Chamber of Commerce. The index seeks to evaluate the internationality of 11 Asian cities based on the feedback gathered from a survey of business executives residing in these cities. Hong Kong ranked first, followed closely by Singapore, recognising Hong Kong’s position as an international financial hub, a centre for international events, and an international hub for world-class education, as well as its safe and stable living environment.

The Asian Cities Internationality Index 2025 Overall Ranking and Scores

While heightened US – China tensions could have slowed cross-border activity, recent significant growth in mainland listings have shown how Hong Kong’s capital markets infrastructure and international connectivity remain appealing to both international investors and Chinese mainland companies seeking new sources of funding.[1][2]

Policy delivers momentum

This resurgence in capital markets has not happened by accident. Authorities on both sides of the border have set out a clear set of policy measures to support increased listing by mainland companies in Hong Kong.

Most recently, the September 2025 Policy Address by Hong Kong Chief Executive John Lee introduced a series of new measures to support the development of financial markets in Hong Kong:

- Tax incentives for sectors such as health technology and advanced manufacturing.

- Simplified listing rules to attract innovative companies.

- New frameworks for renminbi and gold trading.

- Support for fintech, artificial intelligence and data-related activity.

- Talent admission and land supply measures to facilitate enterprise growth.[3][4]

With Hong Kong as the only common law jurisdiction in China, it is a natural home for complex transactions, cross‑border investment, and international arbitration. The combination of legal certainty and market access remains a key factor in location decisions for multinational firms.

Strengthening Hong Kong’s international connectivity

To further support its international connectivity, the government in Hong Kong has also expanded programmes to attract experienced professionals in finance, law, technology and aviation. Major conferences and industry events continue to draw investors and corporates to the territory. These activities aim to support business development, promote market dialogue and signal policy direction to international audiences.

Technology and market connectivity

Authorities have also set out to prioritise financial technology and data‑driven services. Policy priorities include supporting the growth of the digital assets sector in Hong Kong, under an evolving set of regulatory standards and policies. We can expect to see further growthin the connectivity of capital markets frameworks that link Chinese mainland and Hong Kong markets, helping issuers to raise capital and giving investors access to a wider universe of securities not only in Hong Kong but also in Shanghai and Shenzhen.

The way forward

Hong Kong’s advantages lie in legal certainty, market infrastructure, and cross‑border connectivity. The government’s current policy agenda seeks to reinforce these strengths while supporting innovation. Delivery against its aims and objectives will further shape investor confidence and market activity in Hong Kong over the next investment cycle.

With our deep roots in Hong Kong, SEC Newgate has spent the past decade helping companies and institutions navigate evolving business, social and political environments that demand advisors with expertise in strategic communications and public affairs. We take pride in supporting our clients as they enter Hong Kong or strengthen their commitment to the city, just as we continue to deepen our own.